Mastering Options Trading: Strategies for Success and Profitability

Learn the basics of options trading and how to make money through strategies such as protective collars and call credit spreads, understand the volatility risk premium and the difference between buying and selling options, and manage risk and avoid common mistakes, all while utilizing options trading platforms and tools for income generation and following advanced strategies for success in options trading.

Introduction to Options Trading

Options trading is a dynamic financial strategy that grants investors the right to buy or sell assets at a predetermined price within a specific timeframe, offering a versatile platform to profit from market movements. To excel in options trading, a solid grasp of fundamental concepts like strike prices, expiration dates, and option premiums is essential to make informed trading decisions. For instance, envision a scenario where a trader purchases a put option for Company A with a strike price of $50 expiring in six months. If Company A’s stock price declines below $50 within the specified timeframe, the trader can exercise the put option, selling the stock at the higher strike price to capitalize on the price difference.

Distinguishing between American and European options is crucial in navigating the options market effectively. American options provide flexibility for investors to exercise their rights at any time before the contract’s expiration, offering strategic advantages in managing positions. Conversely, European options can only be exercised at the contract’s maturity, requiring a more calculated approach to trading strategies. Understanding these distinctions empowers traders to tailor their strategies based on market conditions and individual preferences, aligning their options trading activities with specific financial goals and risk tolerances.

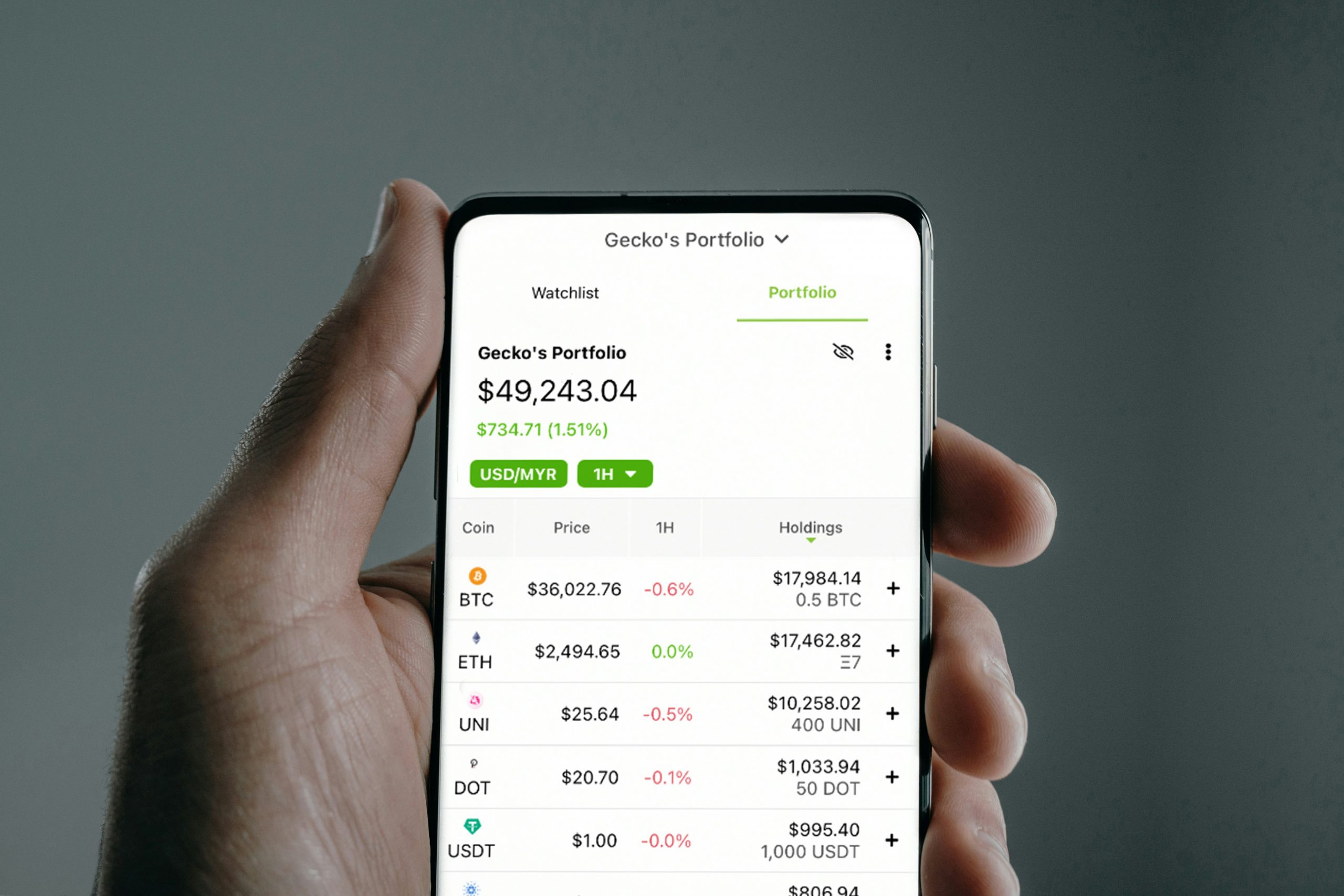

Furthermore, options trading platforms like Schwab IRAs and VectorVest play a pivotal role in providing traders with the tools and resources necessary for successful trading experiences.[2]. Schwab IRAs have specific restrictions on trades like borrowing money to buy stock and engaging in naked short calls, which can influence the range of options trading strategies available in these accounts. On the other hand, platforms such as VectorVest offer comprehensive tools and guidance tailored to options traders, simplifying stock selection and providing buy/sell recommendations to enhance trading performance. By leveraging these platforms effectively, traders can streamline their trading processes, access real-time data, and make well-informed decisions to optimize their trading outcomes.

Understanding the Volatility Risk Premium

The Volatility Risk Premium is a critical component that influences options trading strategies and profitability, with its fluctuations impacted by various market events. For instance, during periods of heightened market uncertainty, such as geopolitical tensions or economic crises, the Volatility Risk Premium tends to increase, reflecting the elevated risk perception in the market. On the contrary, in calmer market conditions with lower volatility, the Volatility Risk Premium may decrease, presenting different challenges and opportunities for traders.

An illustrative example of the Volatility Risk Premium’s impact can be observed during the financial crisis of 2008. As global markets experienced unprecedented turmoil and volatility, the Volatility Risk Premium surged, reflecting the heightened market risk during that period. Traders who were able to anticipate and capitalize on this increased premium through strategic options trading approaches tailored to the market conditions could potentially have reaped substantial profits. Additionally, adjusting notional size based on implied volatility levels is a practical risk management technique that can help traders optimize their performance and returns when engaging with the Volatility Risk Premium. This adjustment allows traders to align their positions with expected levels of volatility, enhancing their ability to capitalize on favorable opportunities in fluctuating market environments.

Fundamental Options Trading Strategies

Exploring fundamental options trading strategies is crucial for traders to enhance their profitability and manage risks effectively [3]. Protective collars involve holding a long position in an underlying asset while simultaneously purchasing a put option and selling a call option on the same asset. This strategy helps protect against significant downside risk while capping the potential upside, making it an attractive choice for conservative investors seeking to hedge their positions.

In contrast, call credit spreads and put credit spreads are strategies that involve selling options contracts to generate income. A call credit spread consists of selling a call option and simultaneously buying a higher strike price call option, aiming to profit from a decline in the underlying asset’s price. On the other hand, a put credit spread involves selling a put option and buying a lower strike price put option to benefit from an increase in the underlying asset’s price. These credit spreads can be effective in generating consistent income in various market conditions, provided traders understand the associated risks and implement them thoughtfully.

Moreover, exploring indexes provided by the Chicago Board Options Exchange (Cboe) can offer valuable insights into the performance of different options trading strategies. By analyzing these indexes, traders can gain a better understanding of how specific strategies have historically fared and make informed decisions when structuring their options trades. Diversifying one’s knowledge across various strategies and staying informed about market trends can significantly enhance the overall trading experience and increase the potential for long-term success in the options market.

Making Money with Options: Buying vs. Selling

The decision between buying and selling options contracts significantly impacts income generation strategies in options trading. Buying options contracts can potentially yield higher returns due to leverage, making it an attractive choice for traders seeking substantial profits. For example, a trader who buys a call option for a stock at $50 with a premium of $3 has the right to purchase the stock at $50 until the option expires. If the stock price rises to $60, the trader can buy the stock at the strike price, sell it at the market price, and profit from the price difference, magnified by the leverage provided by the option contract.

On the other hand, selling options contracts involves receiving premiums from options buyers, which can be a consistent source of income for traders. For instance, a trader who sells a put option on a stock at a strike price of $100 with a premium of $5 obligates themselves to buy the stock at $100 if the option is exercised. If the stock price remains above $100 until expiration, the trader keeps the premium received as profit. Selling options can be likened to collecting insurance premiums; the seller receives payment upfront and assumes the risk associated with adverse price movements. By carefully selecting the right options to sell based on market conditions and risk assessment, traders can create a steady income stream through selling options contracts.

Options Trading in Retirement Accounts

Options trading in retirement accounts, such as IRAs, offers investors the potential to enhance their investment strategies based on specific conditions and the types of options used. For instance, traders with options approval level 2 in their IRAs can utilize strategies like covered calls and short call verticals to optimize their investment portfolios. A covered call strategy within an IRA involves holding a long position in a particular asset while simultaneously selling a call option on the same asset, generating income for the investor while capping the potential upside of holding the asset.

Furthermore, in the context of retirement accounts, the use of long index put verticals can serve as a risk management tool for investors with long positions in their IRAs. For example, a long index put vertical strategy allows an investor to hedge against potential downside risk in the broader market by purchasing put options at a specific strike price while simultaneously selling further out-of-the-money put options. This approach provides defined risk protection in the IRA portfolio, ensuring that losses are limited while still allowing for potential profits if the market experiences a decline. By incorporating these strategies into their retirement accounts, investors can effectively manage risk and optimize their investment performance within the IRA framework.

Risk Management in Options Trading

Effective risk management is a cornerstone of successful options trading, requiring traders to assess their readiness, create comprehensive trading plans, and understand tax implications. Proper risk management strategies include using protective puts as insurance against portfolio losses and employing calendar spreads for volatility and interest rate management. By implementing these risk management techniques, traders can navigate changing market conditions with confidence and adaptability.

Additionally, successful options trading demands constant monitoring, risk assessment, and the ability to adapt to evolving market dynamics. Traders must remain vigilant in analyzing their positions, adjusting strategies as needed, and staying informed about market trends to make informed decisions. By fostering a proactive approach to risk management and remaining adaptable to market shifts, traders can enhance their long-term success in options trading.

Common Mistakes to Avoid in Options Trading

Avoiding common pitfalls in options trading is essential to preserving capital and maximizing profitability. One prevalent mistake is not aligning the trading plan with financial goals, leading to inconsistent performance. To illustrate, a trader who fails to set clear objectives and adhere to a structured plan may struggle to achieve desired outcomes consistently. By aligning trading strategies with specific financial goals and risk tolerances, traders can establish a clear roadmap for success in the options market.

Furthermore, novice options traders often overlook the importance of conducting thorough analysis and refining strategies based on experience, which can result in missed opportunities and potential losses. For example, a trader who neglects to review past trades, analyze market trends, and adjust strategies accordingly may fail to capitalize on profitable opportunities or mitigate risks effectively. Novice traders should focus on building a solid foundation in basic options trading concepts before venturing into more complex strategies to ensure a comprehensive understanding and successful trading experience.

Moreover, novice traders must avoid complex strategies like butterflies and Christmas trees until they have a solid grasp of the fundamental principles of options trading. These intricate strategies require a deep understanding of market dynamics, risk assessment, and advanced options pricing models, making them more suitable for experienced traders who are well-versed in options trading intricacies. By starting with simpler strategies and gradually expanding their knowledge base, beginners can build confidence and proficiency in navigating the complexities of the options market effectively.

Options Trading Platforms and Tools

Selecting the right options trading platform and utilizing the appropriate tools are essential for optimizing trading performance. Online brokers with robust options trading features can streamline the trading process and enhance performance for options traders. These platforms often provide advanced analytics, real-time data, and customizable trading interfaces that cater to the diverse needs of options traders, empowering them to make well-informed decisions and execute strategies efficiently.

Furthermore, VectorVest offers a range of tools and guidance for profitable options trading, simplifying stock selection and offering valuable insights to traders. By leveraging platforms like VectorVest, traders can access buy/sell recommendations, stay informed about market trends, and enhance their overall trading experience. Additionally, Schwab IRAs have restrictions on specific trades like borrowing money to buy stock, affecting the options trading strategies available in these accounts. Understanding these limitations is crucial for traders looking to maximize their opportunities while operating within the boundaries set by their brokerage.

Strategies for Income Generation through Options

Generating income through options trading involves employing various strategies tailored to different market conditions and risk profiles. Selling covered calls and selling puts on dividend-paying undervalued stocks are recommended strategies for conservative income generation. Selling covered calls involves owning shares of a stock and selling call options against those shares, allowing investors to earn premiums while potentially reducing their cost basis in the underlying stock. This strategy is particularly appealing for those seeking to generate income while maintaining ownership of the underlying asset.

Moreover, selling puts on dividend-paying undervalued stocks is another strategy that can be utilized for income generation. By selling puts, investors commit to buying a stock at a predetermined price within a specific timeframe, receiving premiums for undertaking this obligation. This strategy is beneficial for investors who are bullish on a stock and willing to potentially acquire it at a lower price while receiving premiums for assuming the obligation to purchase the shares. These income generation strategies can be enhanced by thorough research, continuous learning, and disciplined risk management, which are essential elements for success in the options market.

Getting Started with Options Trading for Beginners

For beginners entering the world of options trading, learning key strategies and gaining practical experience are crucial steps in building a solid foundation. Long calls, covered calls, and protective puts are fundamental strategies that beginners should focus on to develop their options trading skills. Long calls give traders the right to buy an underlying asset at a predetermined price within a specified timeframe, offering an opportunity to benefit from potential price increases while limiting risk. Covered calls involve owning the underlying asset and selling a call option on the same asset, providing a way to generate income through premiums while holding the asset.

Moreover, finding a reputable broker that offers options trading strategies and obtaining approval for trading options are essential steps for beginners entering the options market. By choosing a broker with user-friendly interfaces, educational resources, and responsive customer support, beginners can enhance their learning curve and trading experience. Gaining approval for options trading involves demonstrating an understanding of the risks involved and the ability to make informed decisions, ensuring that beginners are equipped to navigate the complexities of options trading effectively. Continuous learning, practice, and exposure to real market scenarios are vital components of a beginner’s journey in mastering options trading, leading to confidence and proficiency in navigating the dynamic landscape of financial markets.

Advanced Options Trading Strategies

Exploring advanced options trading strategies allows traders to delve into intricate approaches that cater to specific market conditions and risk profiles. Long call butterfly spreads and iron condors are examples of advanced strategies that involve combining multiple positions for specific market conditions. In a long call butterfly spread, traders buy a call option at a lower strike price, sell two call options at a higher strike price, and buy another call option at an even higher strike price. This strategy aims to capitalize on a specific range-bound market expectation, where the underlying asset’s price is anticipated to remain relatively stable within a defined range.

Furthermore, mastering advanced options trading strategies requires a deep understanding of market dynamics, risk assessment, and advanced options pricing models. Traders who engage in advanced strategies like iron condors demonstrate proficiency in navigating various market scenarios with agility and confidence. Protective puts and calendar spreads are essential components of advanced options trading strategies, providing risk management tools to safeguard investments and optimize trading performance in volatile market conditions. By incorporating these strategies into their trading repertoire, advanced options traders can enhance their profitability and effectively manage risks in the ever-changing landscape of the options market.

Conclusion: Keys to Success in Options Trading

Continuous education, thorough analysis, and disciplined risk management are fundamental factors in achieving success in options trading. Aligning trading strategies with long-term financial goals and adapting to changing market dynamics can lead to consistent profitability in the options market. Options trading offers a dynamic and versatile platform for investors to profit from market movements while managing risks effectively through strategic planning and execution. By fostering a proactive approach to risk management, staying informed about market trends, and making informed decisions based on thorough analysis, traders can navigate the complexities of options trading with confidence and resilience, ultimately leading to long-term success and profitability in the options market.